Introduction to Lifetime ISAs

The Lifetime Individual Savings Account (ISA) has gained significant attention as a vital financial product aimed at helping individuals save for their first home or retirement. Introduced in 2017, this unique savings vehicle offers tax-free growth and government bonuses, making it an attractive option for young savers. With rising property prices and escalating living costs, understanding the benefits and rules of Lifetime ISAs is more crucial than ever.

Key Features of a Lifetime ISA

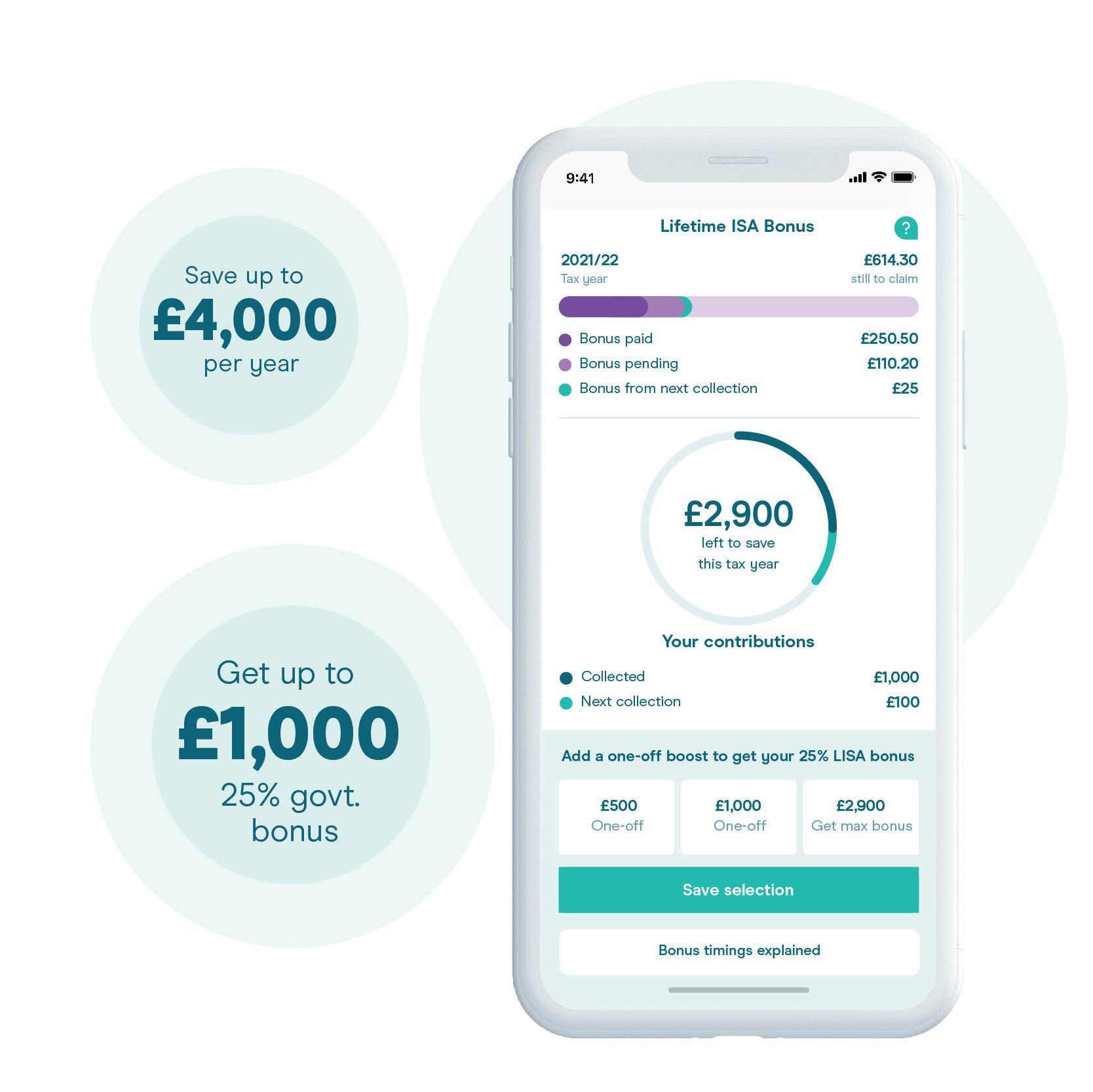

The Lifetime ISA allows individuals aged between 18 and 39 to save up to £4,000 each tax year, with the government adding a 25% bonus to contributions. This means that for every £4 you save, the government contributes an additional £1, up to a maximum of £1,000 per year. Consequently, by the time a person turns 50, they could potentially accumulate a significant sum, benefiting from both their savings and the government’s contribution.

Use of Funds

Funds accumulated within a Lifetime ISA can be withdrawn penalty-free for the purchase of a first home, provided the property costs £450,000 or less and is located in the UK. Alternatively, savers can choose to access their funds tax-free at age 60 to support their retirement. However, it is essential to note that any other withdrawals before these milestones will incur a 25% government withdrawal charge, which effectively negates the bonus received.

Current Trends and Considerations

Recent data shows an increase in popularity for Lifetime ISAs, particularly among first-time homebuyers, who are increasingly finding it a helpful tool in a challenging housing market. According to HM Revenue and Customs (HMRC), in the last financial year, approximately 100,000 accounts were opened, illustrating the growing awareness and utilisation of this savings method.

Moreover, financial advisors are increasingly recommending Lifetime ISAs as part of a holistic approach to financial planning, especially for younger individuals who may be unfamiliar with the complexities of saving for both a home and retirement simultaneously.

Conclusion and Future Outlook

As governments continue to seek ways to support homeownership and retirement savings, the Lifetime ISA remains a significant part of the UK financial landscape. With its unique combination of savings incentives, it provides an opportunity for savers to grow their funds substantially. Looking ahead, individuals should keep abreast of any changes in regulations or bonuses which may affect their financial goals. Awareness and proper management of Lifetime ISAs can empower young savers to build a secure future, whether that be through homeownership or retirement savings.

You may also like

Understanding Tax: Its Importance and Recent Changes

Current Insights on Shell Share Price

Strategies to Enhance Your Savings in 2023

SEARCH

LAST NEWS

- Remembering Wendy Richard: The Promise to Co-Star Natalie Cassidy

- How Did Anglian Water Achieve an ‘Essentials’ Rating for Mental Health Accessibility?

- Shai Hope Leads West Indies in T20 World Cup Clash Against South Africa

- What We Know About Weston McKennie: Future at Juventus and Past at Leeds

- What We Know About the Upcoming Live Nation Antitrust Trial