The Importance of Gold Prices

Gold has long been regarded as a safe-haven asset, and its price trends are closely watched by investors, economists, and governments worldwide. As economic conditions fluctuate, many turn to gold for stability, which makes understanding gold prices essential for several reasons, including investment strategies, inflation hedging, and currency valuation.

Current Trends in Gold Prices

As of October 2023, gold prices have experienced significant volatility, largely influenced by various factors including geopolitical tensions, inflation rates, and changes in currency values. Recently, gold has traded between £1,450 and £1,500 per ounce. Analysts note that these fluctuations have been driven by rising concerns over global inflation and the potential for economic slowdowns in major economies.

Factors Influencing Gold Prices

Several key factors are currently influencing gold prices:

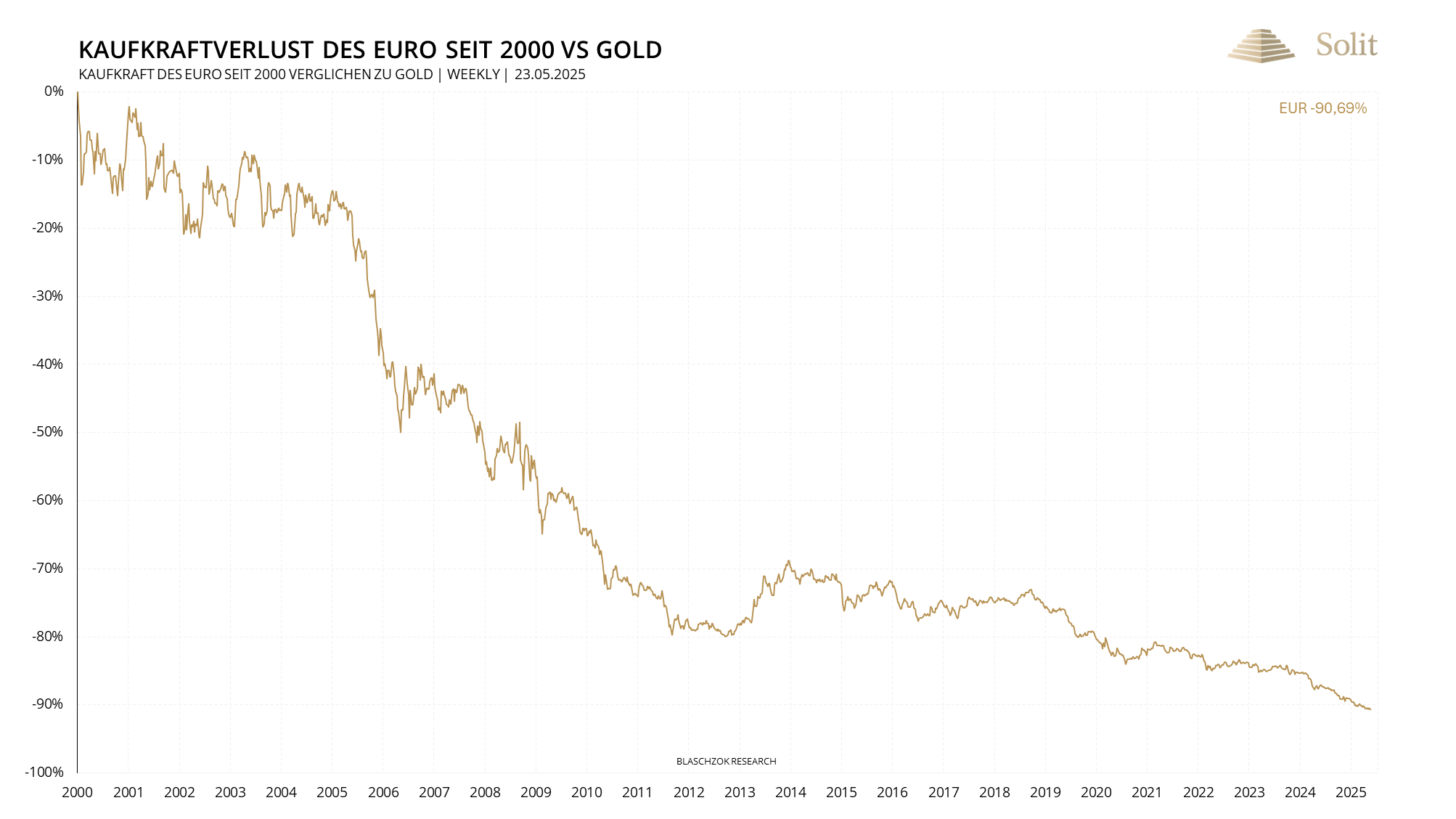

- Inflation: High inflation rates in major economies have led to increased demand for gold as a hedge against currency devaluation.

- Central Bank Policies: The policies of central banks, especially the US Federal Reserve, play a significant role. Recent talks of interest rate hikes have caused fluctuations in gold demand and pricing.

- Geopolitical Instability: Ongoing conflicts and tensions, particularly in Eastern Europe and the Middle East, have driven investors to seek safe-haven assets like gold.

Outlook for Gold Prices

Experts predict that gold prices may continue to fluctuate in the coming months. While some analysts believe that prices could surge if inflation persists and geopolitical tensions escalate, others suggest that market corrections could result in lower prices temporarily. Furthermore, any shifts in monetary policies or unexpected economic indicators could drastically affect the trajectory of gold prices.

Conclusion

For investors, keeping an eye on gold price trends is crucial in 2023. Understanding the broader economic context and the specific drivers affecting gold can aid in making informed investment decisions. As always, due diligence and careful analysis are recommended when considering gold as part of a diversified portfolio.

You may also like

Understanding Tax: Its Importance and Recent Changes

The Dynamics of Price in the Modern Economy

Current Insights on Shell Share Price

SEARCH

LAST NEWS

- Remembering Wendy Richard: The Promise to Co-Star Natalie Cassidy

- How Did Anglian Water Achieve an ‘Essentials’ Rating for Mental Health Accessibility?

- Shai Hope Leads West Indies in T20 World Cup Clash Against South Africa

- What We Know About Weston McKennie: Future at Juventus and Past at Leeds

- What We Know About the Upcoming Live Nation Antitrust Trial