Introduction

The Nikkei 225 is one of the most important stock indices in Asia and is closely watched by investors globally. It reflects the performance of 225 significant companies listed on the Tokyo Stock Exchange, thus serving as a barometer for the Japanese economy. Understanding its current trends and fluctuations is vital for investors looking to navigate the complexities of both the Japanese market and the broader financial landscape.

Recent Performance

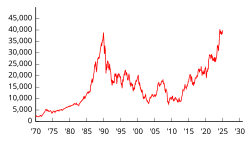

As of late October 2023, the Nikkei 225 has experienced notable volatility, reflecting broader geopolitical tensions and economic uncertainties. Recent data reveals that the index has fluctuated dramatically, reaching a peak of 32,000 points earlier this month before settling at around 31,500 points by the 25th of October. Analysts attribute this rise primarily to strong corporate earnings reports from key sectors, including technology and automotive manufacturing, as Japanese companies continue to recover from the disruptions caused by the COVID-19 pandemic.

Market Influencers

Several factors are influencing the current trends of the Nikkei 225. Firstly, the Bank of Japan’s monetary policy remains a significant element, with the central bank maintaining low-interest rates to stimulate economic growth. Furthermore, the yen’s recent depreciation against major currencies has benefited exporters, fuelling optimism in the stock market.

Additionally, international factors, such as the ongoing tensions in the Asia-Pacific region and fluctuations in global oil prices, are impacting investor sentiment. The recent changes in US monetary policy have also resonated in Japan’s markets, as investors remain cautious regarding potential interest rate hikes.

Future Outlook

Looking ahead, market analysts express a cautious but optimistic outlook for the Nikkei 225. Many believe that if the domestic economic recovery continues, alongside stable global conditions, the index could break its previous highs. However, risks remain, particularly from geopolitical unrest and potential shifts in monetary policy.

In conclusion, the Nikkei 225 serves as a vital indicator not just for Japan but for global investment patterns. Understanding its movements and the factors influencing them is essential for investors looking to make informed decisions. As the market evolves, keeping an eye on both domestic and international developments will be crucial for predicting future trends.

You may also like

Understanding Tax: Its Importance and Recent Changes

The Dynamics of Price in the Modern Economy

Current Insights on Shell Share Price

SEARCH

LAST NEWS

- Remembering Wendy Richard: The Promise to Co-Star Natalie Cassidy

- How Did Anglian Water Achieve an ‘Essentials’ Rating for Mental Health Accessibility?

- Shai Hope Leads West Indies in T20 World Cup Clash Against South Africa

- What We Know About Weston McKennie: Future at Juventus and Past at Leeds

- What We Know About the Upcoming Live Nation Antitrust Trial