Introduction

The state pension is a crucial component of retirement planning for millions of individuals in the United Kingdom. With the ageing population and increasing life expectancy, the state pension system plays a vital role in ensuring financial stability for retirees. Understanding the intricacies of the state pension and its current relevance is essential, especially as recent changes and updates affect eligibility and payments.

What is the State Pension?

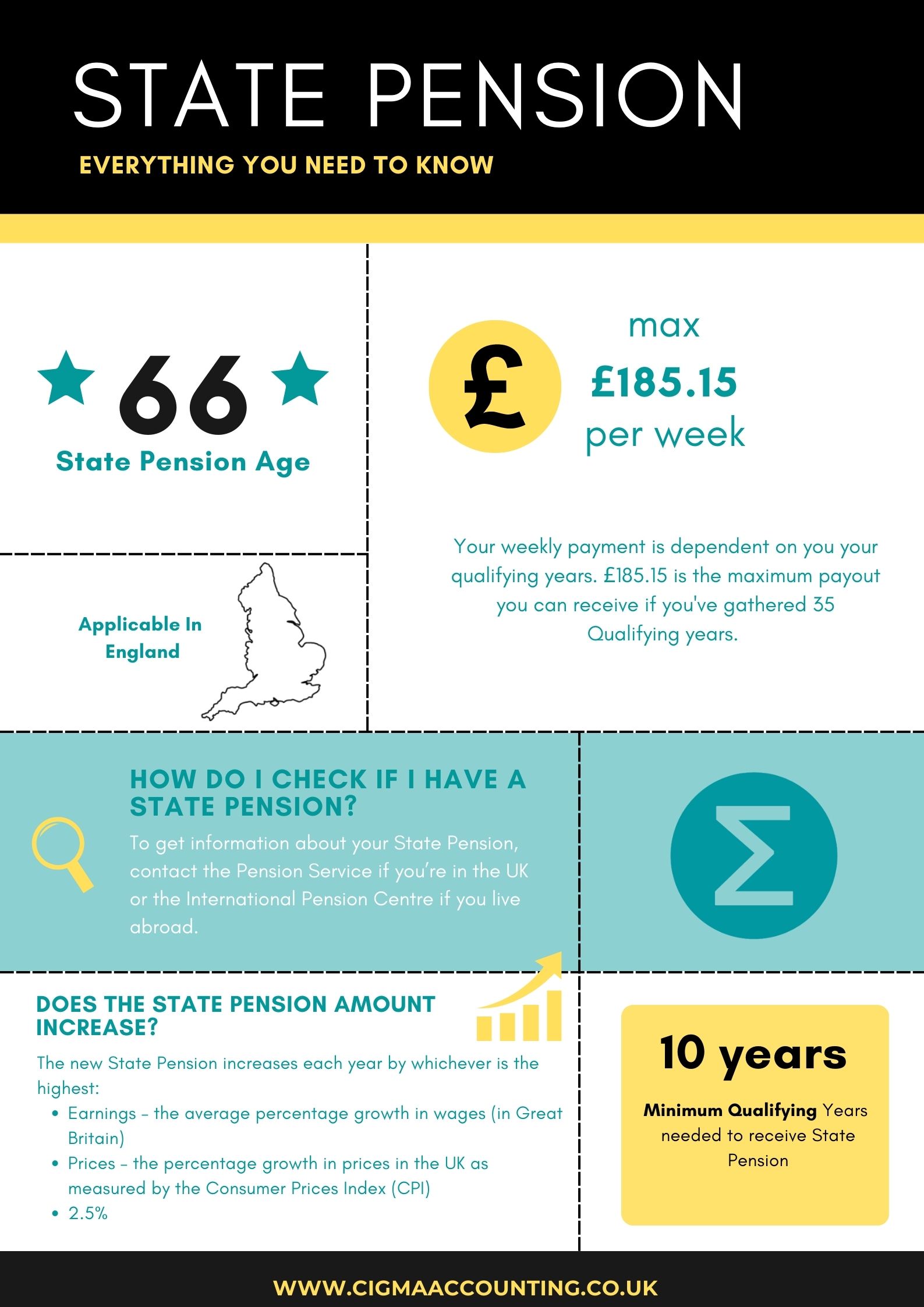

The state pension is a regular payment made by the government to individuals who have reached retirement age. It is designed to provide a basic level of income to support older people in their daily lives. The current state pension system in the UK is divided into two main schemes: the Basic State Pension and the New State Pension, which was introduced in April 2016. The New State Pension aims to simplify and provide a fairer payment structure for those reaching state pension age after this date.

Recent Changes and Updates

As of April 2023, the full new state pension stands at £203.85 per week for those who have made sufficient National Insurance contributions. However, this rate is subject to annual reviews, with the government often announcing increases in alignment with the rate of inflation or average earnings. Recent changes also reflect an ongoing commitment to pension reforms, which include discussions around increasing the state pension age due to demographic changes. Currently, individuals born after 6 April 1978 should expect to retire at age 68, but this is still subject to review by the government.

Impact on Retirees

The state pension significantly affects the financial security of retirees. Many rely exclusively on it to cover basic living costs such as housing, food, and healthcare. With the cost of living rising, pensions are coming under increasing scrutiny, as many argue that the state pension is insufficient to provide a comfortable standard of living. Additionally, those who have gaps in their National Insurance contributions may receive reduced payments, leading to concerns about poverty among the elderly.

Future Considerations

Looking ahead, the future of the state pension system remains a topic of debate. With increasing life expectancy, economic pressures, and demographic shifts, the government may need to consider reforms to ensure the sustainability of the state pension. It’s advisable for individuals to stay informed about their eligibility, contributions, and the potential changes to the pension scheme which may occur in the coming years.

Conclusion

The state pension is a fundamental aspect of retirement for many in the UK. With ongoing changes and considerations about its adequacy and sustainability, it becomes increasingly important for individuals nearing retirement to understand how to maximise their benefits. By staying informed and planning their finances accordingly, future retirees can strive for a secure and stable financial future.

You may also like

Understanding Tax: Its Importance and Recent Changes

Current Insights on Shell Share Price

Strategies to Enhance Your Savings in 2023

SEARCH

LAST NEWS

- Remembering Wendy Richard: The Promise to Co-Star Natalie Cassidy

- How Did Anglian Water Achieve an ‘Essentials’ Rating for Mental Health Accessibility?

- Shai Hope Leads West Indies in T20 World Cup Clash Against South Africa

- What We Know About Weston McKennie: Future at Juventus and Past at Leeds

- What We Know About the Upcoming Live Nation Antitrust Trial