Introduction

The state pension age is a crucial aspect of the UK’s social welfare system, determining when individuals can start receiving their state pension. Understanding the state pension age is essential for planning one’s retirement and ensuring financial stability during the later years of life. Recently, discussions surrounding the state pension age have gained traction, especially considering the ongoing demographic shifts and economic factors impacting the UK.

Current State Pension Age

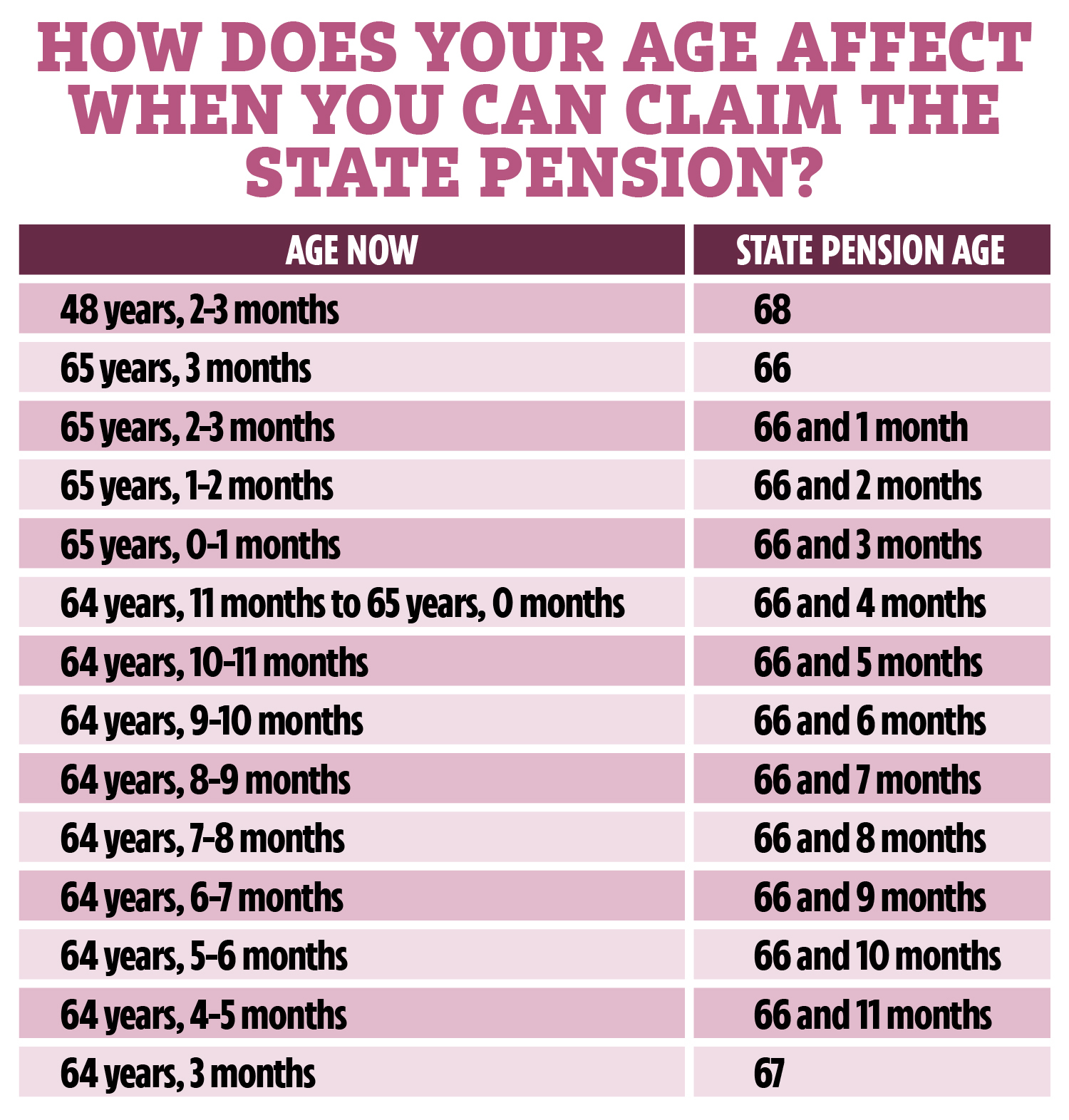

As of 2023, the state pension age in the UK is currently set at 66 for both men and women. This is part of a phased increase that began in 2010, which aimed to reflect increasing life expectancy and to ensure the sustainability of the pension system. The government plans to raise the state pension age further to 67 between 2026 and 2028, with a potential increase to 68 later on depending on life expectancy trends.

Factors Influencing Changes

The adjustments to the state pension age have been influenced by several factors. Firstly, the increasing life expectancy means that people are living longer and healthier lives, which puts pressure on the pension system. A report from the Office for National Statistics shows that the average life expectancy for men in the UK is now around 79.4 years, while for women, it is approximately 83.1 years. Secondly, there’s a pressing need for fiscal responsibility as the ratio of workers to retirees continues to shift, necessitating reforms.

Recent Developments and Controversies

Recently, there have been public outcries concerning the speed and nature of the increases, particularly how they affect those nearing retirement age, with many people unable to adjust their retirement plans accordingly. In April 2023, a parliamentary committee report urged the government to delay the increase to the state pension age to 68 until 2035, highlighting concerns about job availability for older workers and the burden on those in physically demanding professions. The government has yet to respond officially to these recommendations, leaving many in uncertainty.

Conclusion and Future Considerations

Understanding the state pension age and its future trajectory is vital for all individuals planning for retirement. With ongoing debates and potential reforms on the horizon, those approaching retirement must stay informed about changes and prepare accordingly. The implications of these changes could significantly impact financial security for millions across the UK. As discussions around the state pension age continue, stakeholders are keenly aware of the challenges that lie ahead, and the importance of a fair and sustainable pension system remains paramount.

You may also like

SEARCH

LAST NEWS

- Kirkcudbright Book Festival Sees Increased Attendance and Diverse Programming

- Real Madrid Stadium Hosts Champions League Victory Against Manchester City

- No Drama This End Horse Shines at Cheltenham Festival

- Colin Jackson Takes on Ambassador Role for Sporting Champions Scheme

- Blackpool fc