Introduction

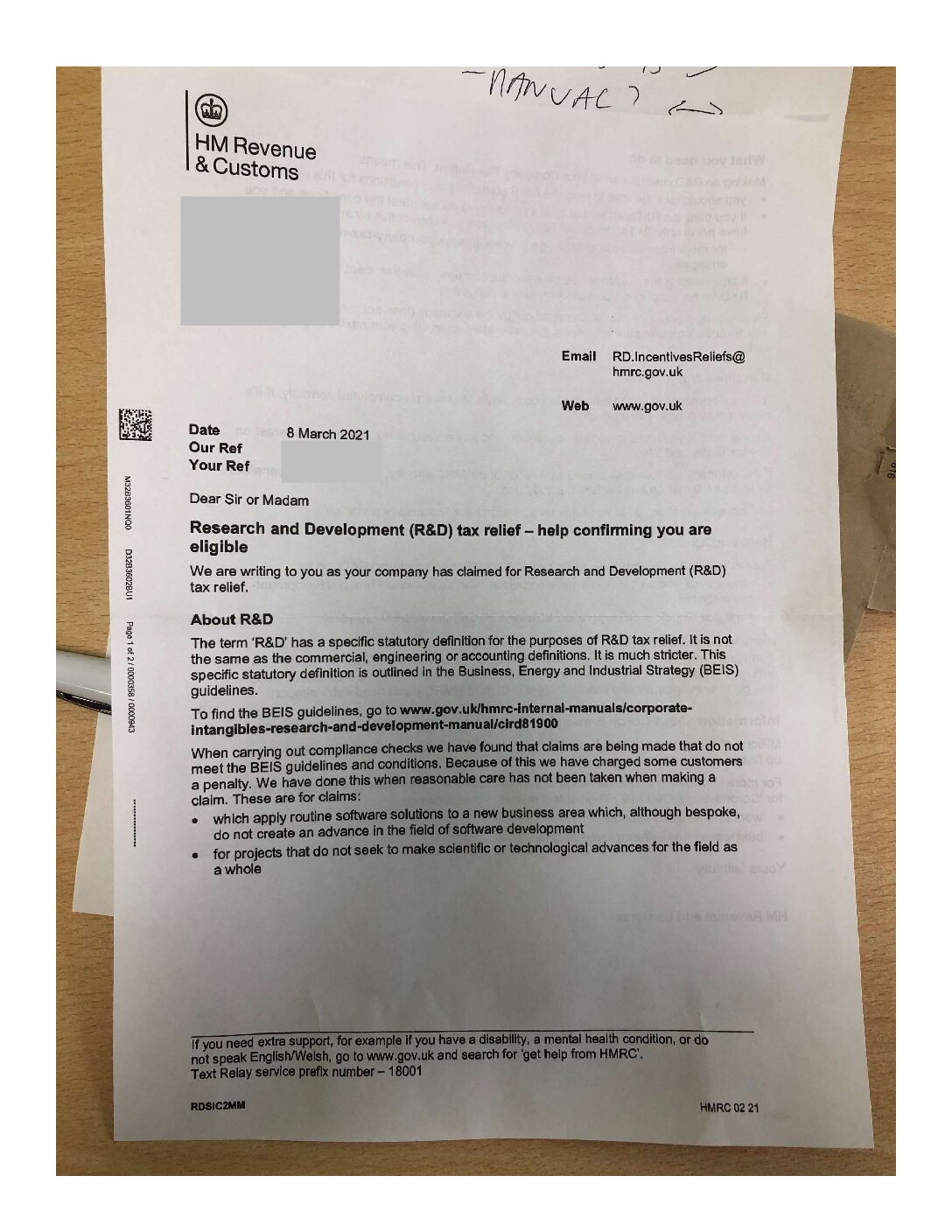

The HM Revenue and Customs (HMRC) is a vital agency of the UK government, responsible for collecting taxes, paying some forms of welfare, and enforcing the minimum wage. Ideally positioned at the heart of the UK’s economy, HMRC’s effectiveness directly impacts public services and the overall economic health of the nation. With recent changes in tax regulations and the ongoing efforts to modernise its processes, understanding HMRC’s operations is more important than ever for taxpayers, businesses, and the public alike.

Recent Developments

In 2023, HMRC has been at the forefront of several significant developments related to tax regulation and compliance enforcement. A notable change includes the rollout of the new Making Tax Digital (MTD) policy, which aims to digitise the VAT process for businesses. As of April 2023, all VAT-registered businesses are now required to keep digital records and submit VAT returns using compatible software. This initiative aims to improve efficiency, reduce errors, and ultimately, increase tax revenue.

Additionally, HMRC has been increasing its focus on tackling tax evasion and fraud, particularly in the wake of the challenges posed by the COVID-19 pandemic. The agency announced a £100 million investment aimed at crackdowns on tax fraud, particularly around schemes misusing COVID-19 support measures. This has been part of a broader strategy to bolster compliance and ensure that tax revenues meet the government’s financial needs.

Implications for Taxpayers and Businesses

For taxpayers, the continuing reforms and enforcement initiatives mean that it is crucial to stay informed and compliant with new regulations. The MTD policy, while beneficial in streamlining processes, also requires businesses to invest in the right software and training for their teams to ensure compliance. As HMRC increases its scrutiny, organisations must maintain accurate and up-to-date records to avoid potential penalties.

Moreover, taxpayers should remain vigilant about their rights in interactions with HMRC. The agency has been praised for its customer service improvements, with better online resources and support now available, demonstrating a commitment to consumer engagement.

Conclusion

In summary, HMRC remains a cornerstone of the UK’s financial framework, continuously evolving to meet the needs of a changing economy. The agency’s ongoing reforms, particularly the Making Tax Digital initiative and its renewed enforcement strategies, are shaping the future landscape of taxation in the UK. As these changes unfold, it is imperative for taxpayers and businesses to engage with HMRC proactively, ensuring compliance and contributing to the broader economic health of the nation. Forecasts suggest that as HMRC further modernises, there will be significant shifts in how taxation is approached, making understanding this agency and its operations essential for all.

You may also like

SEARCH

LAST NEWS

- Kirkcudbright Book Festival Sees Increased Attendance and Diverse Programming

- Real Madrid Stadium Hosts Champions League Victory Against Manchester City

- No Drama This End Horse Shines at Cheltenham Festival

- Colin Jackson Takes on Ambassador Role for Sporting Champions Scheme

- Blackpool fc